how often should you compare car insurance quotes

Worried your car insurance is costing you too much? You’re not alone. Many drivers stick with the same insurance company for years, assuming loyalty is rewarded, but this can often lead to overpaying significantly.

Understanding when and how often to compare car insurance quotes is a key element of smart financial decisions for vehicle owners. Keeping an eye on the market ensures you're not leaving money on the table and that your auto coverage breakdown still fits your needs.

A simple action you can take today: set a reminder on your calendar to review your car insurance options at least once a year. This small step can make a big difference in your premium savings.

Why Comparison Shopping Matters

The insurance landscape is constantly shifting. New companies enter the market, existing insurers adjust their rates, and your own circumstances change. Simply put, what was the best deal last year might be far from it this year. Comparison shopping is the most direct path toward unlocking potential savings, allowing you to make informed choices for your vehicle protection planning.

Think of it this way: car insurance companies assess risk differently. One insurer might prioritize your driving record above all else, while another might place more emphasis on the type of car you drive or your credit score. By comparing quotes from multiple providers, you gain a comprehensive view of the market, revealing who values your specific profile the most. This empowers you to choose the policy that provides the optimal balance of coverage and cost. Beyond pure cost savings, comparison shopping can uncover better coverage options, discounts you weren’t aware of, or simply a company that offers superior customer service. It's about ensuring that your auto insurance aligns with your unique needs and budget.

How Often is "Often Enough?"

There’s no one-size-fits-all answer, but here are some guidelines to consider: Annually:At a minimum, you should compare car insurance quotes once a year. This allows you to stay abreast of market changes and ensures your current policy remains competitive. Even if you're generally happy with your provider, taking 30 minutes to compare rates could uncover significant savings.

Major Life Changes: Significant life events often trigger the need for a car insurance review. These events can impact your risk profile and therefore your premiums. Examples include: Moving: A new address can drastically alter your rates. Urban areas typically have higher premiums than rural ones due to increased traffic density and a higher risk of accidents and theft.

Marriage or Divorce: Marriage often leads to lower rates, as insurers view married couples as more stable drivers. Conversely, divorce can sometimes lead to an increase.

Adding or Removing a Driver: Adding a teen driver to your policy will almost certainly increase your premiums. Conversely, removing a driver (e.g., a child moving out) can decrease them. Don't forget to look into teen insurance tips before adding them to your policy.

Buying a New Car: The type of car you drive significantly impacts your insurance rates. A sports car will generally be more expensive to insure than a family sedan.

Changes in Driving Record: A clean driving record typically translates to lower premiums. However, accidents or traffic violations can cause your rates to increase. It's especially important to compare quotes after any changes to your driving record to see how different insurers react.

Policy Renewal: When your policy is up for renewal, your current insurer will typically send you a renewal notice outlining your new premium. This is a great opportunity to compare that renewal rate against quotes from other companies. Don't automatically accept the renewal offer without first exploring your options.

Significant Premium Increase: If your premium suddenly jumps without any apparent reason (no accidents, tickets, or life changes), it's definitely time to shop around. The insurer may have adjusted their rates across the board, and you might be able to find a better deal elsewhere.

What factors affect car insurance rates?

Numerous factors influence your car insurance premium. These include your age, gender, driving record, the type of car you drive, your location, your credit score (in most states), and the coverage limits and deductibles you choose. Insurers use these factors to assess the risk of insuring you. The higher the perceived risk, the higher the premium.

How can I lower my monthly premium?

There are several strategies to potentially lower your car insurance premium. Increasing your deductible will generally reduce your premium, but you'll have to pay more out of pocket if you file a claim. Bundling your car insurance with other policies (e.g., home or renters insurance) can often result in a discount. Maintaining a clean driving record is crucial, as is improving your credit score. Additionally, you can explore discounts for safe driving courses, low mileage, or having anti-theft devices installed in your car.

What’s the difference between liability and full coverage?

Liability coverage protects you if you're at fault in an accident that causes injury or property damage to others. It covers their medical bills and car repair costs. Full coverage typically includes liability, plus collision and comprehensive coverage. Collision covers damage to your car if you hit another vehicle or object, regardless of fault. Comprehensive covers damage to your car from events like theft, vandalism, fire, or natural disasters. Liability is the minimum coverage required by most states, but full coverage offers broader protection.

The Comparison Shopping Process

Now that you know when to compare, let's walk through the process.

1.Gather Your Information: Before you start getting quotes, gather all the necessary information. This includes your driver's license, vehicle registration, current insurance policy details, and driving history. Having this information readily available will streamline the quoting process.

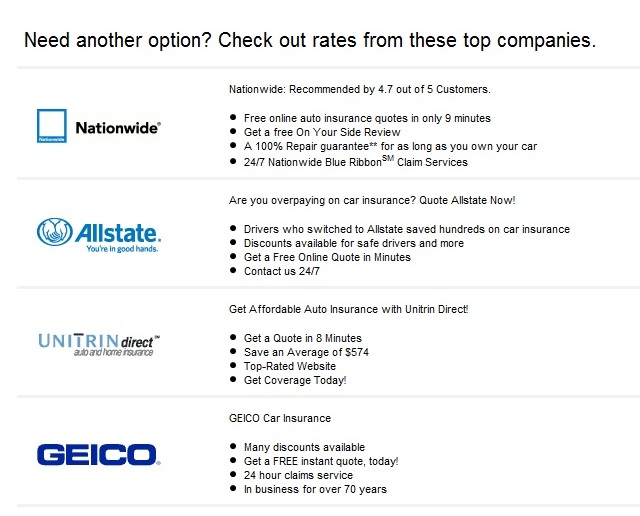

2.Choose Your Comparison Method: You have several options for comparing car insurance quotes: Online Comparison Websites:These websites allow you to enter your information once and receive quotes from multiple insurers. They can save you time and effort, but be sure to read reviews and understand how they make money (some may be biased towards certain insurers).

Directly from Insurers: You can visit the websites of individual insurance companies and request quotes directly. This can be more time-consuming, but it allows you to get quotes from companies that may not be listed on comparison websites.

Independent Insurance Agents: These agents work with multiple insurance companies and can provide you with quotes from several providers. They can also offer personalized advice and help you choose the right coverage.

Captive Insurance Agents: These agents work exclusively for one insurance company. While they can provide expert knowledge about that company's products, they can't offer quotes from other insurers.

3.Provide Accurate Information: Be honest and accurate when providing information for your quotes. Inaccurate information can lead to inaccurate quotes or even policy cancellation.

4.Compare Apples to Apples: When comparing quotes, make sure you're comparing the same coverage levels and deductibles. A lower premium might seem appealing, but it could come with less coverage or a higher deductible, leaving you vulnerable in the event of an accident.

5.Consider More Than Just Price: While price is important, it shouldn't be the only factor you consider. Look at the insurer's financial stability, customer service ratings, and claims process. A company with a slightly higher premium but excellent customer service might be a better choice in the long run.

6.Read the Fine Print: Before making a decision, carefully read the policy documents to understand the terms and conditions of coverage. Pay attention to exclusions, limitations, and other important details.

Common Car Insurance Mistakes to Avoid

Beyond not comparing quotes often enough, here are some other common car insurance mistakes to avoid: Choosing the Lowest Possible Coverage:While it's tempting to save money by opting for the minimum required coverage, this can leave you financially vulnerable in the event of a serious accident. Consider purchasing enough coverage to protect your assets.

Not Understanding Your Policy: Take the time to read and understand your policy documents. Know what's covered, what's not, and what your responsibilities are.

Failing to Update Your Policy: Keep your policy up to date with any changes in your life, such as a new address, a new car, or a change in drivers.

Not Taking Advantage of Discounts: Many insurers offer discounts for things like safe driving, good grades, or bundling policies. Be sure to ask about available discounts.

Filing Small Claims: Filing too many small claims can increase your premiums. Consider paying for minor repairs out of pocket to avoid impacting your insurance rates. Remember to keep your car finance checklist comprehensive.

By understanding these common mistakes, you can proactively avoid them and ensure you have the right coverage at the best possible price.

Armed with these strategies, you’re now well-equipped to proactively manage your car insurance. Regularly comparing quotes and avoiding common pitfalls will allow you to confidently navigate your vehicle protection planning and secure the most favorable rates — feeling empowered to make smart financial decisions and optimizing your auto coverage breakdown in the process.

Post a Comment for "how often should you compare car insurance quotes"